This article is part of TechXchange: Advanced Display Technology

What you’ll learn:

- Advantages of silicone optical bonding materials.

- How various processing options influence bonding techniques and curing mechanisms.

From cars, smartphones, and wearables to digital signage, electronic displays are a fast-growing part of everyday life (Fig. 1). As demand increases, display manufacturers need optically clear bonding materials that attach glass or plastic screens to a wide range of electronic modules. Strong, reliable adhesion is important, but so is support for an exceptional viewing experience. In addition, display manufacturers need solutions for high-volume assembly and a low total cost of ownership.

The incentives for choosing the right optical bonding materials are especially strong due to the accelerating worldwide demand for electronic displays. If the display market experiences the compound annual growth rate (CAGR) of 7.4% predicted by Allied Market Research, its global value will reach USD $206.29MM by 2025.1 Consumer electronics and automotive interior displays are some of the fastest-growing market segments, but displays are now used in many industries.

Common Challenges and Industry-Specific Requirements

Silicone-based optically clear resins (OCRs) are a good choice for bonding display components. This is because these innovative materials provide reliable adhesion to glass, plastic, or metal and exhibit high optical transmittance, low haze, and minimal yellowing for display readability and visibility. Silicone-based OCRs also support automated assembly and can reduce operational costs with energy-efficient curing.

Importantly, silicone-based OCRs are able to withstand harsh, application-specific environments and demanding test conditions. In the automotive industry, for example, interior displays must endure high temperatures and humidity along with prolonged exposure to sunlight. Consequently, test conditions include high-temperature degradation testing at 105°C, constant-humidity testing with 85% relative humidity (RH) at 85°C, and thermal shock tests with temperatures ranging from −40 to 95°C. Accelerated weathering and light stability testing with proprietary equipment is also used to determine display reliability.

Although electronic displays were once limited to luxury vehicles, they’re now found in many new cars and trucks. Potential buyers like these vehicle features and value displays that support greater comfort and safety. With consumer devices such as smartphones and laptops, buyers want displays that are dependable, reliable, user-friendly, and stylish. Ruggedness, as defined by ingress-protection (IP) codes under International Electrotechnical Commission (IEC) standard 60529, is also in demand. For example, smart watches with an IP67 rating are marketed for their water resistance and, by extension, durability.

Other industries have different requirements. For example, military and aerospace displays combine mission-critical reliability with adherence to standards such as MIL-STD-810G from the U.S. Department of Defense (Fig. 2). Medical displays need to withstand repeated cleaning with chemicals and, in the case of touchscreens, be responsive to users with gloved hands. The large displays used for public information, security and safety need optical bonding materials that can be dispensed easily in relatively large quantities and that will not experience significant rates of volume shrinkage.

Next-Gen Displays and Emerging Technologies

Next-generation displays that use emerging technologies will require optical bonding materials that provide even greater levels of performance and reliability. For example, as automakers seek to differentiate their product lines, luxury cars are adding more digital instrument clusters along with head-up displays and rear-seat entertainment systems. In addition to curved displays, automotive design trends include the use of larger and wider dual displays, three-dimensional digital gauge clusters, and side-mirror displays that include cameras for improved safety.

According to Market Research Future, the CAGR for global automotive displays will reach 13% between 2017 and 2023 as product innovation accelerates.2 Liquid crystal displays (LCDs) currently dominate automotive markets, but engineers prefer organic light-emitting diodes (OLEDs) because they don’t require backlighting and provide greater design freedom over LCDs. Also, in virtually all electronic sectors, 5G electronics with greater power densities increase the amount of heat generated when devices are turned on. For this reason, optical bonding materials for next-generation displays must resist higher temperatures as well as thermal cycling.

Within the consumer electronics space, flexible OLEDs (FOLEDs) support foldable and roll-up displays such as television screens that can be easily hidden away when not in use. According to Research and Markets, FOLEDs are expected to experience a CAGR of 39% between 2019 and 2024.3 By 2025, their total market potential could reach $100MM. For display engineers and consumers alike, FOLEDs are increasingly attractive because they have virtually infinite color contrast and support less obtrusive displays with thinner form factors.

White OLED (WOLED), quantum-dot OLED (QD-OLED) and quantum-dot LED (QD-LED) also offer advantages for next-generation displays. With their high resolution, these emerging technologies are a good choice for high-end televisions. According to Goldstein Research, the overall market for OLED TVs is expected to reach $5MM in 2025.4 WOLED technology combines color tunability with significant energy savings while QD-OLED and QD-LED can create full-color displays that are superior to the white-backlit LCDs used in most televisions.

For the mini LED backlight units (BLUs) that are expected to compete with OLED technology, the display industry needs optical bonding materials that can support local dimming with a wide color range. Typical applications made with mini LED BLUs include tablets, computer monitors, automotive displays and smartphones. According to Yole, mini LED BLUs will have a CAGR of greater than 90% between 2019 and 2023.5

Micro LEDs, another emerging technology, provide high resolution (<2000 ppi) and a wide viewing angle. As Transparency Market Research reports, micro LEDs are expected to achieve a CAGR of greater than 20% from 2018 to 2026.6 For engineers who design televisions and medical wearables, it may likely become increasingly important to find optical bonding materials that can withstand the high heat and poor thermal dissipation associated with this display technology.Advantages of Silicone Optical Bonding Materials

To support today’s products and tomorrow’s designs, optical bonding materials must avoid cracking and resist bubbling, a problem caused by outgassing or lamination. In addition, if there are chemical reactions between different display substrates, the polarizers for LCDs may become discolored. Yellowing, another common problem, is typically caused by UV light; however, chemical contact can also induce this unsightly discoloration. Further, mura, an industry term that describes clouding and irregularities on LCD and OLED screens, can result from mechanical stress in a display’s touch-sensing area.

When selecting optical bonding materials, engineers can choose products with organic or inorganic chemistries (Fig. 3). Silicone-based OCRs are inorganic and help to avoid the common problems associated with electronic displays. They also provide performance advantages over organic materials.

For example, in addition to lower levels of outgassing, silicones have good chemical and moisture resistance. They resist UV light, too, and with their low modulus provide excellent stress relief. In fact, silicone-based OCRs can absorb some of the stress that results when disparate display materials such as glass, metals, and plastics expand and contract at different rates. These same stress-relieving properties can also help if a handheld device is dropped. By contrast, organics tend to be rigid and may crack when subjected to impact.

In terms of optical properties, silicone-based OCRs provide high optical transparency so that light passes through a cover window or touch panel without significant scattering. These materials are also characterized by high transmittance for brighter displays and low haze. Yet, engineers can choose products with a specific refractive index, a measure of how light propagates through a material.

Furthermore, silicone-based OCRs are available with different amounts of adhesion and hardness. Along with thermal stability, silicones provide higher temperature resistance compared to what organic materials can withstand. That’s especially important as 5G electronics become more popular.

Engineers can choose silicone-based OCRs supplied as two-part products that require mixing or as one-part products that don’t need to be mixed. With their instant green strength, or handling strength, silicone-based OCRs form strong bonds quickly and can withstand assembly operations such as pressing display modules and display screens together. They also provide reworkability for reduced waste and long open times for ease of use. Plus, unlike organic materials, silicone-based OCRs don’t have demonstrated weaknesses during the rigorous testing requirements associated with specific industries.

For high-volume manufacturing, silicone-based OCRs come in a range of rheologies to support the demands of automated dispensing. Faster-flowing products fill channels rapidly and cover large surface areas, while slower-flowing products are used to extend dispensing times when a slight movement after dispensing is required. Finally, highly thixotropic OCRs allow for quick dispensing with exact placement and without overflow.

Bonding Techniques and Curing Mechanisms

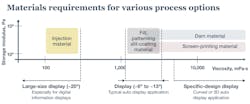

Silicone-based OCRs support various bonding processes and curing mechanisms. Liquid optical bonding processes include dam and fill, patterning, slit coating, screen printing, and dam and injecting (Fig. 4). The bonding technique may be a function of the display size and type. Curing can be achieved with UV light, heat, or a combination of both. Many of the optical bonding materials on the market today are one-part and UV-cured. Two-part materials typically use thermal curing in ovens that require more energy and have a larger footprint.

During thermal curing, applied heat initiates chemical crosslinking of the resin molecules. Cure temperatures and durations can be optimized based on the heat cure profile of the silicone-based OCR. Heat curing improves wetting and lowers viscosity, but it adds complexity because two-part materials are used. By contrast, one-part UV-cured materials simplify the optical bonding process and use energy-efficient UV lamps that provide radiation at a specific wavelength and energy intensity.

In terms of bonding processes, the dam-and-fill method uses both UV precuring and full UV curing. This multi-step process dispenses an OCR onto the corners of a display module and then onto the middle of a cover window. The damming fluid that’s used forms a barrier on the substrate to keep the dispensed OCR inside the defined perimeter.

Patterning, another liquid optical bonding process, dispenses the silicone-based OCR into an X-shaped pattern on a cover window that’s then attached to the display module. As the OCR spreads across the substrate, heat is applied. Full curing is achieved with UV energy. Slit coating, on the other hand, applies a layer of OCR to a cover window and then uses a UV precure. After the cover window is attached to the module, full UV curing occurs.

Screen printing, another liquid optical bonding process, dispenses the material onto a mask frame to coat a specific area of the module. After a squeegee blade spreads the OCR, the cover window is attached and UV energy is used for full curing. Another bonding process—dam and injecting—first dispenses the dam material onto the module. After the cover window is attached, the OCR is inserted into the laminated display. Full curing is achieved with UV energy, but a side cure may be applied.

Innovative Silicone Solutions

Two innovative products demonstrate the benefits of using silicone-based OCRs with UV curing. These one-part UV-curable materials are designed to resist cracking, hazing, and yellowing from sunlight, humidity, and high and low temperature extremes. Moreover, these transparent and solvent-less materials are extremely soft after curing to help provide cushioning and stress relief for delicate electronics. Before and after reliability testing, both silicone-based OCRs deliver consistent optical transmittance of greater than 99%.

Another silicone-based solution, an electrode protective resin (EPR), can be used with these optical bonding materials to optimize the reliability of display modules where mechanically sensitive electrodes may be exposed to moisture, heat, impact, and especially UV light. This silicone-based EPR avoids incompatibility issues that may arise if an organic EPR is used with a silicone-based OCR. The consequences of using incompatible chemistries can include haze, yellowing, and softening of the silicone OCR under high temperatures (up to 105°C) and UV levels in automotive interiors.

Engineers have a choice of optical bonding materials, but silicone-based OCRs offer clear advantages over organic materials for the design and manufacture of electronic displays. Optically clear silicone-based resins support current display designs that are exposed to harsh environments and next-generation displays that are thinner, foldable, curved, and are subject to 5G’s high temperature demands. Further, silicone-based technologies can keep pace with continued improvements in automated dispensing and energy-efficient curing as display manufacturers seek to capture a larger share of fast-growing markets.

Jayden Cho is Global Marketing Segment Leader, Consumer Electronics, and Johnny Park is Technical Service and Development Scientist, Consumer Solutions, at Dow.

Read more articles in TechXchange: Advanced Display Technology

References

1. Allied Market Research (September 2018) “Display Market by Display Type – Global Opportunity Analysis and Industry Forecast, 2018-2025.” (Accessed: July 30, 2020)

2. Market Research Future (July 2020) “Global Automotive Smart Display Market Research Report – Forecast Till 2025.” (Accessed: July 30, 2020)

3. Research and Markets (July 2018) “Global Flexible OLED Display Market – Forecasts from 2018 to 2023.” (Accessed: July 30, 2020)

4. Goldstein Research (May 2020) “Global OLED TV Market Size, Market Segmentation By Technology.” (Accessed: July 30, 2020)

5. Yole (November 2019) “MiniLED Displays 2019.” (Accessed: July 30, 2020)

6. Transparency Market Research (July 2020) “Micro LED Display Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2018 – 2026.” (Accessed: July 30, 2020)